Powering Customer Insights

Innovative solutions for Customer Verification & on-boarding, AML, KYC and Credit Reports. Driving growth, efficiency, and success.

Get in touch

How VRFYD Works

Simplify client ID checks in 3 steps

Secure ID Verification Link

Send your customer an invitation with a unique verification link or call our API.

Initiated

Checks

Our system conducts the necessary checks and provides the requested data.

Completed

Checks

We return your customers results via our API or accessible via your partner portal

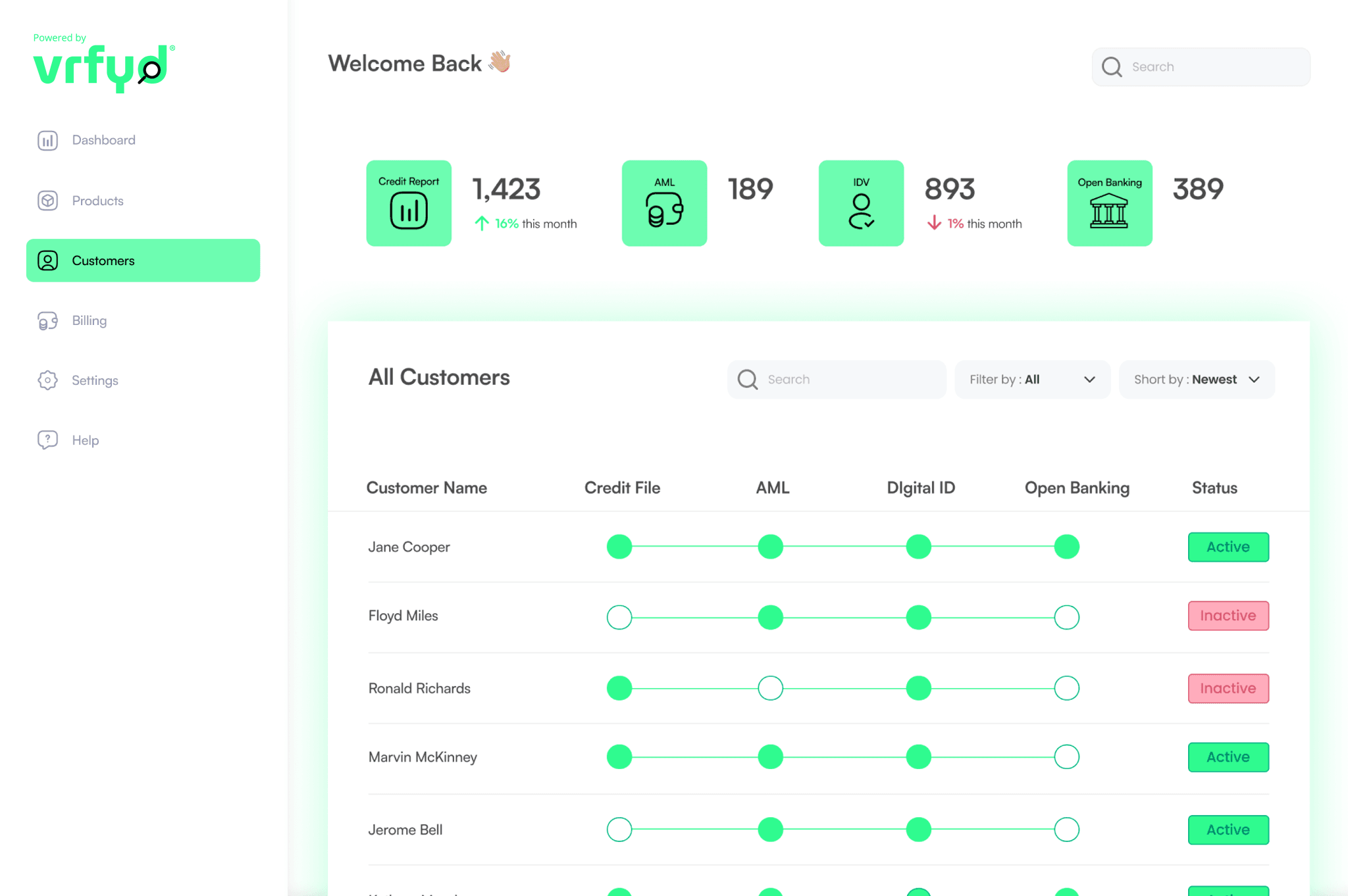

Customisable Solutions For Customer

Verification & Onboarding

Reduced

Onboarding Time

Automation streamlines the KYC process, resulting in faster customer onboarding times.

Enhanced

Compliance

Automated systems can be programmed to stay up to date with changing regulatory requirements, ensuring the KYC process remains compliant with evolving standards and helping financial institutions avoid regulatory penalties.

Cost

Savings

Automated KYC processes help cut operational costs associated with manual labor, paper-based documentation, and error correction.

Customer Verification Solutions

you’ll love

Live Customer

Success Team

Our VRFYD customer success team are available through our live chat in-app or on your dashboard. To help you get more from our services.

VRFYD

Checks Library

VRFYD checks against financial information with open banking, PEPs, Sanctions, Mortality and credit file.

Customer Verification

Solutions

Build verification solutions with your business case and clients' needs in mind, and help us create the best verification solutions for you.

FAQ